Understanding the US Budget Deficit: A Cartoonist’s Perspective

The US budget deficit is a complex issue, often simplified—or even ridiculed—in political cartoons. But behind the humor lies a serious economic reality with far-reaching consequences. This article explores the causes and implications of the US budget deficit, drawing on insights from political cartoons and economic analysis.

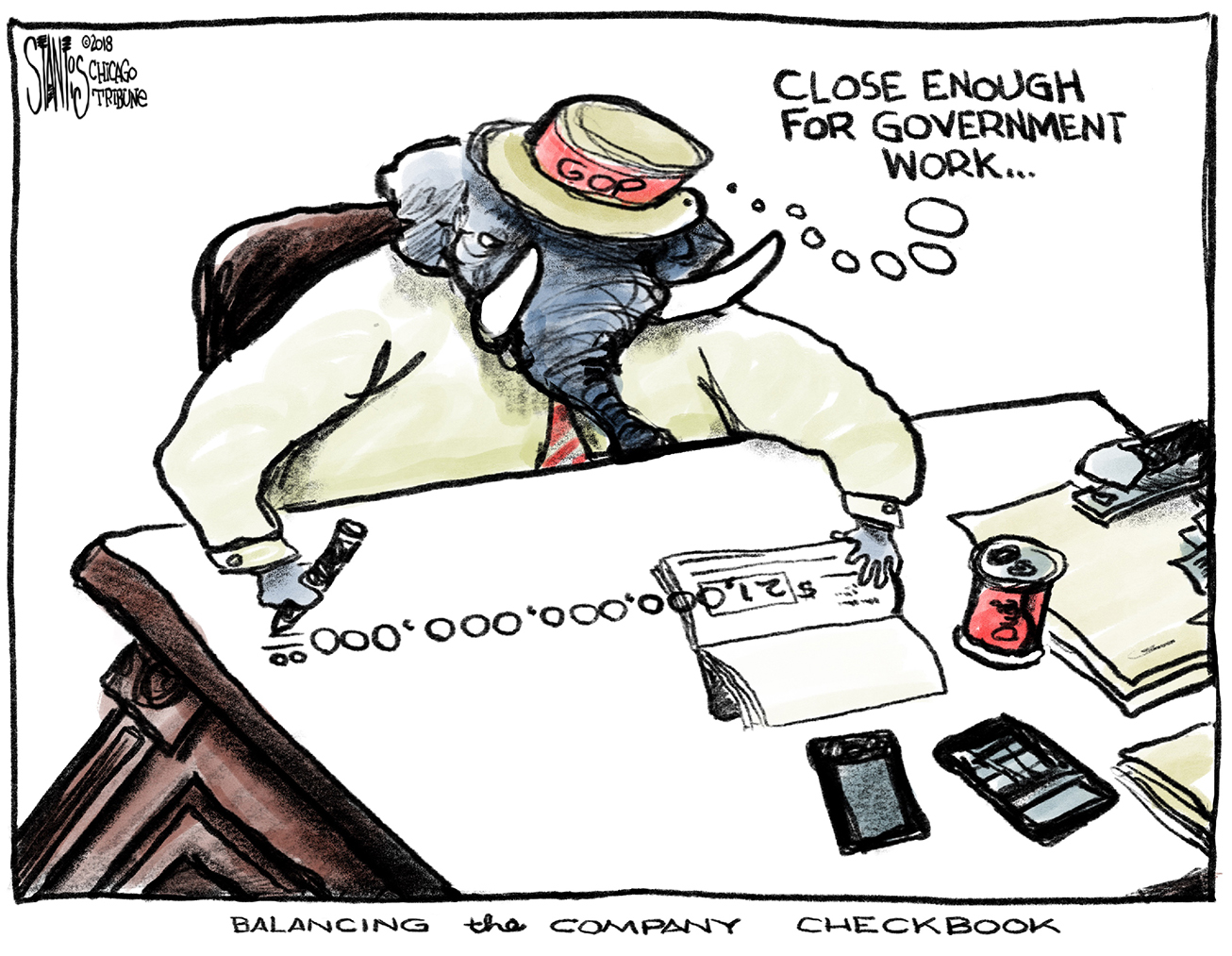

The US Budget Deficit: A Visual Representation

Political cartoons offer a unique lens through which to examine the US budget deficit. Artists like Peter Kuper and Dave Granlund, whose works are featured in publications like Cagle Cartoons, often use satire and visual metaphors to highlight the absurdity and consequences of unsustainable government spending. Kuper’s cartoon, “Rising U.S. Budget Deficits and Our Future,” might depict a precarious stack of dollar bills teetering on the edge of a cliff, symbolizing the nation’s growing debt. Granlund’s “Deficit and Budget Cuts” could show a politician desperately trying to plug holes in a leaking bucket representing the federal budget, highlighting the inadequacy of simple budget cuts as a solution.

These visual representations simplify complex economic issues, making them accessible to a wider audience. However, the cartoons also serve as a reminder that the budget deficit is not just a collection of numbers; it’s a reflection of political choices and their impact on the nation’s economic well-being. The use of humor and exaggeration can be effective in drawing attention to a serious issue, prompting viewers to seek a deeper understanding of the underlying economic forces. The cartoons serve as a starting point for more in-depth conversations about fiscal policy and its impact on individuals and society.

Furthermore, the prevalence of budget deficit cartoons in publications and online platforms underscores the public’s interest in this issue. The widespread use of such cartoons demonstrates their effectiveness in communicating complex economic concepts in a readily digestible format. The accessibility and engaging nature of these visual representations make them a powerful tool for raising public awareness about the budget deficit and its implications. The cartoons’ popularity also suggests a desire for simpler explanations of complex economic issues, providing avenues for further exploration and analysis.

Causes of the US Budget Deficit: A Deeper Dive

The US budget deficit arises from a gap between government spending and revenue. Several factors contribute to this imbalance. Increased government spending on social programs, healthcare, national defense, and infrastructure projects can significantly contribute to the deficit. Tax cuts, while stimulating economic growth, can reduce government revenue, exacerbating the deficit. Economic downturns reduce tax revenue while simultaneously increasing demand for social safety nets, further widening the gap.

The interplay between these factors makes the US budget deficit a dynamic and complex issue. Examining historical data reveals fluctuations in the deficit over time, correlating with periods of economic expansion and contraction, changes in government policy, and shifts in global economic conditions. Understanding these complex interrelationships requires considering a range of economic indicators and evaluating the effectiveness of different policy interventions. The challenge lies in finding a balance between addressing immediate needs and implementing long-term sustainable fiscal policies.

Moreover, understanding the national debt, the accumulation of past budget deficits, is crucial. The national debt represents the total amount of money the US government owes to its creditors, both domestic and international. A rising national debt can lead to higher interest payments, crowding out other government spending, and potentially impacting the country’s credit rating. Managing the national debt requires a coordinated approach, involving careful consideration of different economic variables and a long-term perspective. The national debt is not merely a financial statistic; it is a reflection of the nation’s fiscal choices and carries significant implications for the future.

The Impact of the Budget Deficit: Implications for the Future

The consequences of a large and persistent budget deficit can be substantial. It can lead to higher interest rates, increased inflation, and reduced economic growth. Higher interest rates make it more expensive for businesses and individuals to borrow money, potentially hindering investment and job creation. Increased inflation erodes the purchasing power of consumers, reducing their disposable income. Reduced economic growth can negatively impact living standards and increase income inequality.

The potential consequences of an unchecked budget deficit extend beyond economic indicators. Social programs could face cuts, leading to reduced access to critical services. National security could be jeopardized due to reduced investment in defense. The nation’s creditworthiness could be diminished, leading to higher borrowing costs and reduced international influence. Addressing the budget deficit requires a comprehensive approach that considers its economic, social, and political dimensions. The long-term impact of the deficit demands proactive and sustainable solutions.

Moreover, the budget deficit also has international implications. Large budget deficits can weaken a country’s currency, impacting trade balances and potentially leading to currency crises. Foreign investors may become less willing to invest in a country with a large and growing budget deficit, further hindering economic growth. International cooperation and coordination are often necessary to manage global financial stability. The budget deficit is not solely a domestic issue, but it carries significant weight in the global economic landscape.

Solutions and Perspectives

Addressing the US budget deficit requires a multi-faceted approach. This may involve a combination of spending cuts, tax increases, and economic reforms. Spending cuts need to be carefully considered to avoid harming essential social programs and national priorities. Tax increases should be designed to promote economic fairness and efficiency. Economic reforms should aim to boost long-term economic growth, increasing government revenue and reducing reliance on deficit spending.

The debate surrounding solutions to the budget deficit is often highly politicized. Different political parties and interest groups have widely varying perspectives on the appropriate balance between spending cuts and tax increases. Finding consensus on fiscal policy requires open dialogue, compromise, and a commitment to long-term sustainability. The challenge lies in finding a politically viable path that addresses the economic challenges while avoiding negative social and economic consequences.

Furthermore, public education and engagement are crucial to building consensus around fiscal policy. A clear and easily understood explanation of the budget deficit’s causes and consequences is essential for fostering informed public debate and encouraging the adoption of sustainable fiscal policies. The complexity of the issue demands transparent and accessible communication, empowering citizens to participate meaningfully in the decision-making process. The public’s understanding and engagement are paramount in shaping effective and sustainable fiscal policies.

Key Takeaways

- The US budget deficit is a complex issue with significant economic and political implications.

- Political cartoons often provide simplified, yet insightful, representations of the problem.

- Several factors contribute to the deficit, including increased spending and reduced revenue.

- A large and persistent deficit can lead to negative economic consequences and social challenges.

- Addressing the deficit requires a multi-faceted approach involving spending cuts, tax increases, and economic reforms.